Many individuals are stepping into da What many don’t notice is that there are totally different markets and monetary devices that one can revenue from.

It trades upwards of two.5 trillion {dollars} per day, which is roughly 1000 instances of the quantity of the New York Stock Exchange. Quite simply, the foreign change market dwarfs the stock market of any nation.

So, the place is the foreign currency market? Well, not like the stock exchanges of the world. The foreign currency market is a digital market that’s related to the web, telephones, and fax. trading could be carried out at night time or early in the morning earlier than going to work.

Other advantages of the foreign currency change embrace:

1. High Leverage: Currency brokers normally give their merchants 100:1 leverage, which means that if there’s $1000.00 in one’s account, they may let one manage $100,000.00, which permits currency merchants

2. High Liquidity: Because the currency market is the biggest market on the planet with big everyday volumes, one is at all times in a position to get out and in of trades as liquidity is rarely a problem.

limits and stops are at all times honored. Orders are executed in a short time, without slippage. In the stock market, it’s much extra frequent that stops get passed over as stock costs plummet, however within the FOREX, one could be much extra assured that the stops are honored.

4. Entry orders are prompt: There isn’t any lag time in inserting an order. Orders are processed immediately on the present market price or the price at which you set the order to enter the market sooner or later.

5. No Commissions: There are not any commissions in currency trading, the dealer simply takes a small distinction between the bid price and the asking price as its price for the transaction.

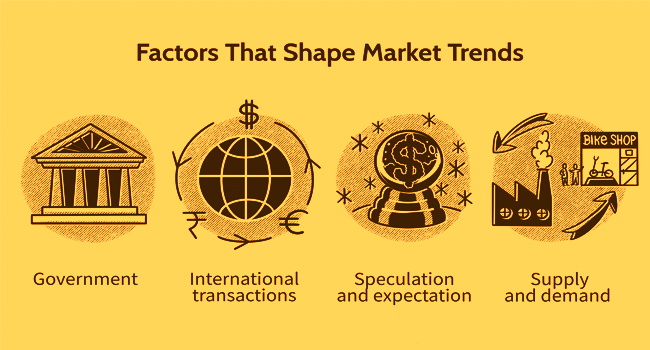

As currency markets are a few of the most unstable markets, many basic variables akin to climate, and battle have an effect on the price of the currency, nonetheless, since there isn’t a one obvious cause much of the time for price motion, the basics get discounted and one can use a virtually purely technical strategy to trading.

As one can see, there are a lot of nice advantages to utilizing FOREX as an extremely worthwhile monetary instrument. Before trading in a residing account, it is very important first to get educated by utilizing books, or online programs. There are many programs online promoting for upwards of $3000.00, however, it’s not essential to spend that type of cash to get superb schooling.. Much of the time one can discover a course for below $500 that teaches the very same content material for much much less cash.

The Benefits of FX Trading